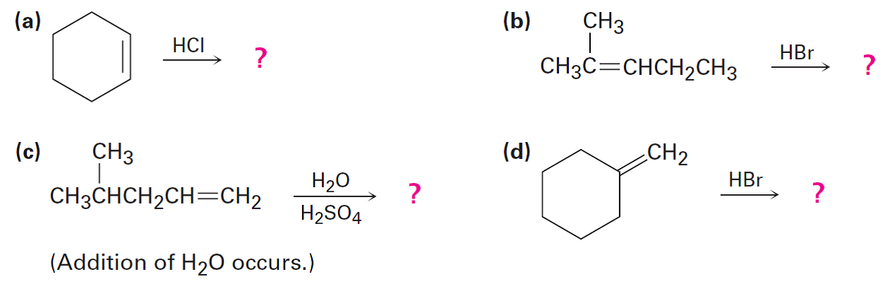

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The following scenario relates to questions 1–5.

Adana died on 17 March 2016, and inheritance tax (IHT) of £566,000 is payable in respect of her chargeable estate. Under the terms of her will, Adana left her entire estate to her children.

At the date of her death, Adana had the following debts and liabilities:

(1) An outstanding interest-only mortgage of £220,000.

(2) Income tax of £43,700 payable in respect of the tax year 2015–16.

(3) Legal fees of £4,600 incurred by Adana’s sister which Adana had verbally promised to pay.

Adana’s husband had died on 28 May 2006, and only 20% of his inheritance tax nil rate band was used on his death. The nil rate band for the tax year 2006–07 was £285,000.

On 22 April 2006, Adana had made a chargeable lifetime transfer of shares valued at £500,000 to a trust. Adana paid the lifetime IHT of £52,250 arising from this gift. If Adana had not made this gift, her chargeable estate at the time of her death would have been £650,000 higher than it otherwise was. This was because of the subsequent increase in the value of the gifted shares.

What is the maximum nil rate band which will have been available when calculating the IHT of £566,000 payable in respect of Adana’s chargeable estate?

A.£325,000

B.£553,000

C.£390,000

D.£585,000

What is the total amount of deductions which would have been permitted in calculating Adana’s chargeable estate for IHT purposes?A.£263,700

B.£268,300

C.£43,700

D.£220,000

Who will be responsible for paying the IHT of £566,000 in respect of Adana’s chargeable estate, and what is the due date for the payment of this liability?A.The beneficiaries of Adana’s estate (her children) on 30 September 2016

B.The beneficiaries of Adana’s estate (her children) on 17 September 2016

C.The personal representatives of Adana’s estate on 30 September 2016

D.The personal representatives of Adana’s estate on 17 September 2016

How much IHT did Adana save by making the chargeable lifetime transfer of £500,000 to a trust on 22 April 2006, rather than retaining the gifted investments until her death?A.£260,000

B.£207,750

C.£147,750

D.£200,000

How much of the IHT payable in respect of Adana’s estate would have been saved if, under the terms of her will, Adana had made specific gifts of £400,000 to a trust and £200,000 to her grandchildren, instead of leaving her entire estate to her children?A.£240,000

B.£160,000

C.£0

D.£80,000

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)