题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

On 1 April 2009 Picant acquired 75% of Sander’s equity shares in a share exchange of three

In addition to this Picant agreed to pay a further amount on 1 April 2010 that was contingent upon the post-acquisition performance of Sander. At the date of acquisition Picant assessed the fair value of this contingent consideration at $4·2 million, but by 31 March 2010 it was clear that the actual amount to be paid would be only $2·7 million (ignore discounting). Picant has recorded the share exchange and provided for the initial estimate of $4·2 million for the contingent consideration.

On 1 October 2009 Picant also acquired 40% of the equity shares of Adler paying $4 in cash per acquired share and issuing at par one $100 7% loan note for every 50 shares acquired in Adler. This consideration has also been recorded by Picant.

Picant has no other investments.

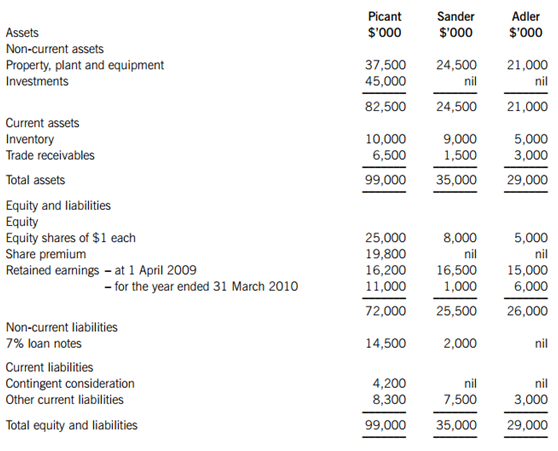

The summarised statements of fi nancial position of the three companies at 31 March 2010 are:

(i) At the date of acquisition the fair values of Sander’s property, plant and equipment was equal to its carrying amount with the exception of Sander’s factory which had a fair value of $2 million above its carrying amount. Sander has not adjusted the carrying amount of the factory as a result of the fair value exercise. This requires additional annual depreciation of $100,000 in the consolidated fi nancial statements in the post-acquisition period.

Also at the date of acquisition, Sander had an intangible asset of $500,000 for software in its statement of fi nancial position. Picant’s directors believed the software to have no recoverable value at the date of acquisition and Sander wrote it off shortly after its acquisition.

(ii) At 31 March 2010 Picant’s current account with Sander was $3·4 million (debit). This did not agree with the equivalent balance in Sander’s books due to some goods-in-transit invoiced at $1·8 million that were sent by Picant on 28 March 2010, but had not been received by Sander until after the year end. Picant sold all these goods at cost plus 50%.

(iii) Picant’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose Sander’s share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest.

(iv) Impairment tests were carried out on 31 March 2010 which concluded that the value of the investment in Adler was not impaired but, due to poor trading performance, consolidated goodwill was impaired by $3·8 million.

The following information is relevant:

(v) Assume all profi ts accrue evenly through the year.

Required:

(a) Prepare the consolidated statement of fi nancial position for Picant as at 31 March 2010. (21 marks)

(b) Picant has been approached by a potential new customer, Trilby, to supply it with a substantial quantity of goods on three months credit terms. Picant is concerned at the risk that such a large order represents in the current diffi cult economic climate, especially as Picant’s normal credit terms are only one month’s credit. To support its application for credit, Trilby has sent Picant a copy of Tradhat’s most recent audited consolidated fi nancial statements. Trilby is a wholly-owned subsidiary within the Tradhat group. Tradhat’s consolidated fi nancial statements show a strong statement of fi nancial position including healthy liquidity ratios.

Required:

Comment on the importance that Picant should attach to Tradhat’s consolidated fi nancial statements when deciding on whether to grant credit terms to Trilby. (4 marks)

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)