题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

As options increase _____, people often begin to feel their life is crashing down on them.

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)

抱歉!暂无答案,正在努力更新中……

抱歉!暂无答案,正在努力更新中……

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)

抱歉!暂无答案,正在努力更新中……

抱歉!暂无答案,正在努力更新中……

更多“As options increase _____, people often begin to feel their life is crashing down on them.”相关的问题

更多“As options increase _____, people often begin to feel their life is crashing down on them.”相关的问题

When home buyers expect their income to increase,______are ideal options for them.

A.SAMs

B.ARMs

C.RAMs

D.GPMs

What does the writer say about the communication options available to senior managers?

A.Sending memos to staff is out of the most efficient methods.

B.It is important to find the time to discuss certain matters with staff.

C.They should increase the range of options that they use.

D.Getting junior managers to talk to staff can create different problems.

Why does CareerSite's agent offer each job hunter only three job options?

A.To focus on better job matches.

B.To attract more returning visits.

C.To reserve space for more messages.

D.To increase the rate of success.

What does the writer say about the communication options available to senior managers?

A.Sending memos to staff is one of the most efficient methods.

B.It is important to find the time to discuss certain matters with staff.

C.They should increase the range of options that they use.

D.Getting junior managers to talk to staff can create different problems.

A、To avoid having to evaluate a customer's credit standing for each sale.

B、To lessen the risk of extending credit to customers who cannot pay.

C、To speed up receipt of cash from the credit sale.

D、To increase total sales volume.

E、All of the options are reasons for credit card use.

A.Change to component A form component B . Component A costs more to purchase but has a lower life-cycle cost than B .

B.Change task A to be component B instead of resource C . Resource B is a more experienced worker .

C.Move tasks B and H to occur concurrently, and take the risk of a 30% increase in the need for five more resources later .

D.Delete an acceptance test from the project plan .

Policymakers and industry have four options: reduce vehicle use, increase the efficiency and reduce the emissions of conventional gasoline-powered vehicles, switch to less harmful fuels, or find less polluting driving systems. The last of these -- in particular the introduction of vehicles powered by electricity is ultimately the 0nly sustainable option. The other alternatives are attractive in theory but in practice are either impractical or offer only marginal improvements. For example, reduced vehicle use could solve traffic problems and a host of social and environmental problems, but evidence from around the world suggests that it is very difficult to make people give up their cars to any significant extent.

Car account for ______ the greenhouse gases in the US.

A.50%

B.40%

C.25%

D.14%

Section B – TWO questions ONLY to be attempted

Arthur Jellicoe has been the chief executive officer (CEO) of Scapa Holdings, a listed company, for over 15 years, during which time the company has been very successful in capturing market share and achieving levels of profitability well in excess of it direct competition. Much of this success has been credited specifically to the way Arthur has managed the company. So when he advised the board at its last meeting that he plans to retire at the end of the year, there was real concern about appointing his successor. Scapa Holdings is particularly aware that any uncertainty which may arise during the CEO transitional period could result in a fall in share price, which they clearly wish to avoid.

The remuneration policy at Scapa Holdings includes a provision for awarding significant share options to executive directors when the company attains high levels of performance. For many years the targets set by the remuneration committee have been exceeded, so Arthur has accumulated a large number of share options which he can exercise any time over the next year. As part of his retirement planning, Arthur has consulted with an independent financial adviser who has recommended that he exercises his share options before he retires because they will deliver a tax efficient capital gain which he can then invest for his future. Clearly it will be in Arthur’s best interest to choose an exercise date when the share price is trading at its highest. So when a new contract opportunity was tabled by the sales director, which would clearly increase the company’s share price this year, Arthur was an enthusiastic supporter. Unfortunately, the finance director advised the board that its bank loan contained a restrictive covenant requiring the company to maintain interest cover of four times its pre-tax profit. Although Scapa Holdings has always been able meet this loan condition, the finance director is concerned that the further investment in the working capital needed for the proposed new contract presented a significant risk of breaching the loan covenant.

To address this issue the CEO suggested that inventory could be valued differently in order to report a higher profit figure, and thereby increase the level of interest cover. He further suggested that ‘this minor policy change would not be opposed by shareholders’ as it would undoubtedly increase the value of the share price. He also advised the board that he was sure that he could use his longstanding friendship with the engagement partner of Scapa Holdings’ auditors, who he had trained with as an accountant many years ago, to convince the audit team to agree with the higher inventory valuation during the forthcoming audit.

Required:

(a) An inherent risk in any listed company is that its directors have the power to pursue their own personal interests, which may not be aligned with their fiduciary duties towards shareholders.

Explain the term conflict of interest in this context, and using information from the scenario, discuss how Arthur Jellicoe’s behaviour presents a clear conflict of interest, stating what course of action he should take. (8 marks)

(b) Describe the agency relationships at Scapa Holdings, and explain how clear accountability could increase trust between principal and agent thereby reducing agency costs. (9 marks)

(c) Explain the meaning of ‘probity’ when maintaining professional business relationships as described in the scenario, and criticise the ethical behaviour of Arthur Jellicoe with respect to probity. (8 marks)

Earlier research by financial economists on backdating practices focused on the extent to which the company's stock price went up abnormally after the grant date. My colleagues and I focused instead on how a grant-date's price ranked in the distribution of stock prices during the month of the grant. Studying the universe of about 19,000 at-the-money, unscheduled grants awarded to public companies' CEOs during the decade 1996-2005, we found a clear relation between the likelihood of a day's being selected as a grant date for awarding options, and the rank of the day's stock price within the price distribution of the month: a day was most likely to be chosen if the stock price was at the lowest level of the month, second most likely to be chosen if the price was at the second-lowest level, and so forth. There is an especially large incidence of "lucky grants" (defined as grants awarded on days on which the stock price was at the lowest level of the month): 12 percent of all CEO option grants were lucky grants, while only 4 percent were awarded at the highest price of the month.

The passage of the Sarbanes-Oxley Act in August 2002 required firms to report grants within two days of any award. Most firms complied with this requirement, but more than 20 percent of grants continued to be reported after a long delay. Thus, the legislation could be expected to reduce but not eliminate backdating. The patterns of CEO luck are consistent with this expectation: the percentage of grants that were lucky was a high 15 percent before enactment of the law, and declined to a lower, but still abnormally high, level of 8 percent afterwards.

Altogether, we estimate that about 1,150 CEO stock-option grants owed their financially advantageous status to opportunistic timing rather than to mere luck. This practice was spread over a significant number of CEOs and firms: we estimate that about 850 CEOs (about 10 percent) and about 720 firms (about 12 percent) received or provided such lucky grants. In addition, we estimate that about 550 additional grants at the second-lowest or third-lowest price of the month owed their status to opportunistic timing.

The cases that have come under scrutiny thus far have led to a widespread impression that opportunistic timing has been primarily concentrated in "new economy" firms. But while the frequency of lucky grants has been somewhat higher in such firms, more than 80 percent of the opportunistically timed grants have been awarded in other sectors. Indeed, there is a significantly higher-than-normal incidence of lucky grants in each of the economy's 12 industries.

According to the passage, more stock-options were granted to executives because

A.responsibilities increase very fast on the shoulders of the executives.

B.they account for a very important part in executives' pay package.

C.shareowners intend to tie executives' interests with their own.

D.shareholders expect executives to buy stocks at exercise price.

Although Alecto Co is of the opinion that it is equally likely that interest rates could increase or fall by 0·5% in four months, it wishes to protect itself from interest rate fluctuations by using derivatives. The company can borrow at LIBOR plus 80 basis points and LIBOR is currently 3·3%. The company is considering using interest rate futures, options on interest rate futures or interest rate collars as possible hedging choices.

The following information and quotes from an appropriate exchange are provided on Euro futures and options. Margin requirements may be ignored.

Three month Euro futures, €1,000,000 contract, tick size 0·01% and tick value €25

March 96·27

June 96·16

September 95·90

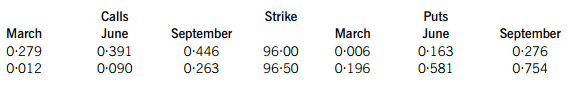

Options on three month Euro futures, €1,000,000 contract, tick size 0·01% and tick value €25. Option premiums are in annual %.

It can be assumed that settlement for both the futures and options contracts is at the end of the month. It can also be assumed that basis diminishes to zero at contract maturity at a constant rate and that time intervals can be counted in months.

Required:

(a) Briefly discuss the main advantage and disadvantage of hedging interest rate risk using an interest rate collar instead of options. (4 marks)

(b) Based on the three hedging choices Alecto Co is considering and assuming that the company does not face any basis risk, recommend a hedging strategy for the €22,000,000 loan. Support your recommendation with appropriate comments and relevant calculations in €. (17 marks)

(c) Explain what is meant by basis risk and how it would affect the recommendation made in part (b) above. (4 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“简答题”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!