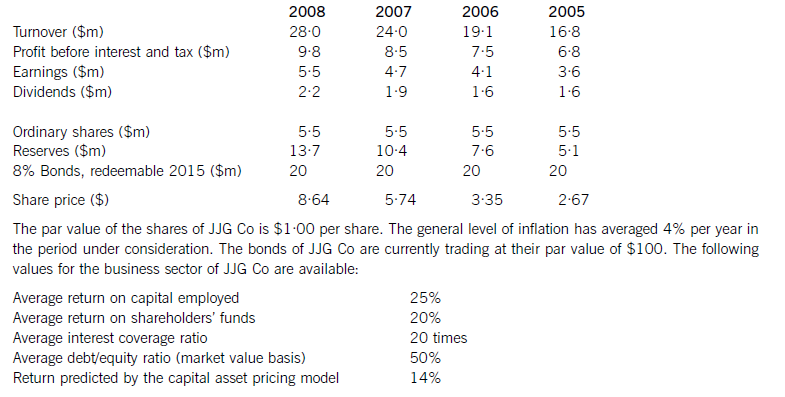

The following scenario relates to questions 6 to 10.Ring Co has in issue ordinary shares w

The following scenario relates to questions 6 to 10.

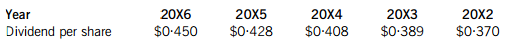

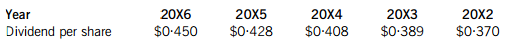

Ring Co has in issue ordinary shares with a nominal value of $0·25 per share. These shares are traded on an efficient capital market. It is now 20X6 and the company has just paid a dividend of $0·450 per share. Recent dividends of the company are as follows:

Ring Co also has in issue loan notes which are redeemable in seven years’ time at their nominal value of $100 per loan note and which pay interest of 6% per year.

The finance director of Ring Co wishes to determine the value of the company.

Ring Co has a cost of equity of 10% per year and a before-tax cost of debt of 4% per year. The company pays corporation tax of 25% per year.

Using the dividend growth model, what is the market value of each ordinary share?

A.$8·59

B.$9·00

C.$9·45

D.$7·77

What is the market value of each loan note?A.$109·34

B.$112·01

C.$116·57

D.$118·68

The finance director of Ring Co has been advised to calculate the net asset value (NAV) of the company.

Which of the following formulae calculates correctly the NAV of Ring Co?

A.Total assets less current liabilities

B.Non-current assets plus net current assets

C.Non-current assets plus current assets less total liabilities

D.Non-current assets less net current assets less non-current liabilities

Which of the following statements about valuation methods is true?A.The earnings yield method multiplies earnings by the earnings yield

B.The equity market value is number of shares multiplied by share price, plus the market value of debt

C.The dividend valuation model makes the unreasonable assumption that average dividend growth is constant

D.The price/earnings ratio method divides earnings by the price/earnings ratio

Which of the following statements about capital market efficiency is/are correct?

(1) Insider information cannot be used to make abnormal gains in a strong form. efficient capital market

(2) In a weak form. efficient capital market, Ring Co’s share price reacts to new information the day after it is announced

(3) Ring Co’s share price reacts quickly and accurately to newly-released information in a semi-strong form. efficient capital market

A.1 and 2 only

B.1 and 3 only

C.3 only

D.1, 2 and 3

请帮忙给出每个问题的正确答案和分析,谢谢!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)