题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

In the inflation period, comparing with the LIFO method, FIFO can produce _____costs of goods sold.

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)

抱歉!暂无答案,正在努力更新中……

抱歉!暂无答案,正在努力更新中……

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)

抱歉!暂无答案,正在努力更新中……

抱歉!暂无答案,正在努力更新中……

更多“In the inflation period, comparing with the LIFO method, FIFO can produce _____costs of goods sold.”相关的问题

更多“In the inflation period, comparing with the LIFO method, FIFO can produce _____costs of goods sold.”相关的问题

A.boosted

B.harnessed

C.staggered

D.embarked

A、20%

B、22%

C、26.5%

D、32%

A、11.79%

B、5.78%

C、C、1.32%

D、6.13%

A.a reduction in output of 20 per cent.

B.a reduction in output of 5 per cent.

C.a reduction in output of 15 per cent.

D.a reduction in output of 35 per cent.

A、government budget deficits do not rise continually

B、the unemployment rate does not rise continually

C、the price level rises continually

D、the government does not experience more than one negative supply shock per decade

A.an acceleration of the rate of increase in the price level

B.an increase in the productivity of business firms and labour

C.a decrease in the rate of inflation

D.no actual change in the price level but an increase in the level of unemployment

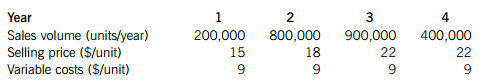

Selling price and variable cost are given here in current price terms before taking account of forecast selling price inflation of 4% per year and variable cost inflation of 5% per year.

Incremental fixed costs of $500,000 per year in current price terms would arise as a result of producing the new product. Fixed cost inflation of 8% per year is expected.

The initial investment cost of production equipment for the new product will be $2·5 million, payable at the start of the first year of operation. Production will cease at the end of four years because the new product is expected to have become obsolete due to new technology. The production equipment would have a scrap value at the end of four years of $125,000 in future value terms.

Investment in working capital of $1·5 million will be required at the start of the first year of operation. Working capital inflation of 6% per year is expected and working capital will be recovered in full at the end of four years.

Hebac Co pays corporation tax of 20% per year, with the tax liability being settled in the year in which it arises. The company can claim tax-allowable depreciation on a 25% reducing balance basis on the initial investment cost, adjusted in the final year of operation for a balancing allowance or charge. Hebac Co currently has a nominal after-tax weighted average cost of capital (WACC) of 12% and a real after-tax WACC of 8·5%. The company uses its current WACC as the discount rate for all investment projects.

Required:

(a) Calculate the net present value of the investment project in nominal terms and comment on its financial acceptability. (12 marks)

(b) Discuss how the capital asset pricing model can assist Hebac Co in making a better investment decision with respect to its new product launch. (8 marks)

A portfolio manager based in the United Kingdom is planning to invest in U.S. bonds with a maturity of one year. Assume that the ratio of the price levels of a typical consumption basket in the United Kingdom versus the United States is 1.2 to 1. The current exchange rate is £0.69 per dollar. The one-year interest rate is 1.76 percent in the United States and 4.13 percent in the United Kingdom. Assume that inflation rates are fully predictable, and expected inflation over the next year is 1.5 percent in the United States and 3.75 percent in the United Kingdom. a. Assuming that real exchange rates remain constant, calculate the real exchange rate, the expected exchange rate in one year, and the expected return over one year on the U.S. bonds in pounds. b. Now assume that the inflation rate over the one-year period has been 1.5 percent in the United States and 3.75 percent in the United Kingdom. Further, assume that the exchange rate at the end of one year is £0.67 per dollar. Calculate the real exchange rate at the end of one year. What is the return on the U.S. bond investment now? Is the return on the U.S. bond the same as in part (a)? Explain.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“简答题”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!