•Read the article below about how to read annual report and the questions on the opposite page.

•For each question 13-18, mark one letter (A, B, C or D) on your Answer Sheet for the answer you choose.

How to read annual reports

First, turn back to the report of the certified public accountant. This third-party auditor will tell you fight off the bat if Galaxy's report conforms with "generally accepted accounting principles". Then go to the footnotes. Check to see whether earnings are up or down. The footnotes often tell the whole story.

Then turn to the letter from the chairman, Usually addressed "to our shareholders," it's up front -- and should be in more ways than one. The chairman's tone reflects the personality, the well- being of the company. In this letter, the chairman should tell you how the company fared this year. But more important, the letter should tell you why. Keep an eye out for sentences that start with "Except for..." and "Despite the..." They're clues to problems. On the positive side, a chairman's letter should give you insights into the company's future and its stance on economic or political trends that may affect it.

Now begin digging into the numbers!

One source is the balance sheet. It is a snapshot of how the company stands at a single point in time. On the top are assets -- everything the company owns. Things that can quickly be turned into cash are current assets. On the bottom are liabilities -- everything the company owes. Current liabilities are the debts due in one year, which are paid out of current assets. The difference between current assets and current liabilities is working capital, a key figure to watch from one annual report to another. If working capital shrinks, it could mean trouble, one possibility: the company may not be able to keep dividends growing rapidly. Owners' equity is the difference between total assets and liabilities. It is the presumed dollar value of what the owners or shareholders own. You want it to grow.

The second basic source of numbers is the income statement. It shows how much money Galaxy made or lost over the year. Most people look at one figure first. It's in the income statement at the bottom: earnings per share. Watch out. It can fool you. Galaxy's management could boost earnings by selling off a plant. Or by cutting the budget for research and advertising. The number you .should look at first in the income statement is net sales. Ask yourself: are sales going up at a faster rate than the last time around? When sales increases start to slow, the company may be in trouble. Have sales gone down because the company is selling off a losing business? If so, profits may be soaring.

Another important thing to study is the company's debt. Turn to the balance, and divide long-term liabilities by owners' equity. That's the debt-to- equity ratio. A high ratio means the company borrows a lot of money to spark its growth. That's okay -- if sales grow too, and d there's enough cash on hand to meet the payments. A company doing well on borrowed money can earn big profits for its shareholders. But if sales fall, watch out. The whole enterprise may slowly sink. Some companies can handle high ratios; others can't.

Finally, you have to compare. Is the company's debt-to-equity ratio better or worse than it used to be? Better or worse than the industry norms? In company-watching, comparisons are all. They tell you if management is staying on top of things.

According to the writer, the most important element of the chairman's letter is

A.the expressions used.

B.the explanations given by the chairman.

C.the performance of the company during the year.

D.the company's future described by the chairman.

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)

简答题官方参考答案

(由简答题聘请的专业题库老师提供的解答)

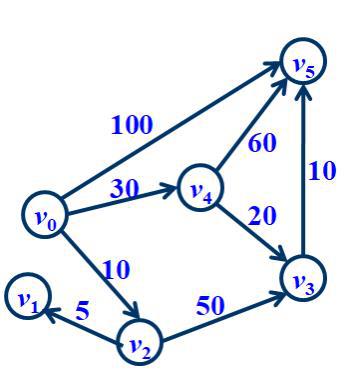

Please give the shortest path and its length from Vetex v0 to each of the other vertices and give the solving process in detail.

Please give the shortest path and its length from Vetex v0 to each of the other vertices and give the solving process in detail.